Coverage The guarantee against specific losses provided under the terms of an Insurance

company.

Benefits are specific areas of Plan coverage’s, i.e.Outpatient visits, Hospitalization and so forth; those make up the range of medical services that a payer markets to his subscribers.

Rider This is an attachment to the policy that modifies its conditions by expanding or restricting benefits or excluding certain conditions from coverage.

called Premium.

- Individual health insurance covers the medical expenses of only one person or family.

- Unlike group insurance, you purchase individual insurance directly from an insurance company.

- When you apply for individual insurance, you are evaluated in terms of how much risk you present.

- This is generally done through a series of medical questions and/or a physical exam.

- Your risk potential determines whether you qualify, and how much your insurance will cost.

- Individual insurance is somewhat more risky for insurers than group insurance, since group insurance allows the insurer to spread risk over a larger number of people. For this reason, individual insurance is generally more difficult to obtain, and more costly than group insurance.

- To get individual insurance, you can either contact the insurer directly, or get in touch with your insurance agent.

- You will probably want to get quotes from several insurance companies before you choose one, just to make sure you are getting the best coverage for your money.

- Before issuing an individual insurance policy, the insurer willwant to know everything about your personal health history.

- Many insurers use information from the Medical Information Bureau to determine whether an applicant is insurable.

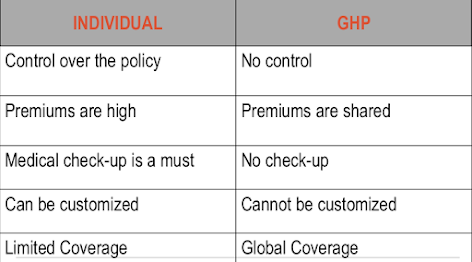

Features of Individual Health Plans

- Single Owner

- Dependant Coverage

- Stringent Medical Check-up

- High Premiums

- Customized Policy

- With group health insurance, a single policy covers the medical expenses of many different people, instead of covering just one person.

- Often, your employer or association pays at least part of the cost of group insurance. But when you purchase individual insurance, however, you are responsible for 100% of the cost (High Premiums)

- Individual insurance often doesn't provide as much coverage as group insurance policies in the same price range (Customized Policy)

- Moreover, individual insurance is often more expensive to make up for the insurer's increased risk exposure.

- Individual insurance coverage is, ironically, much easier to come by when you are healthy.

- If you are already sick or have a history of health problems, you may find it difficult to obtain coverage.

- Group insurance, by contrast, is usually available without taking a medical examination or answering health questions.

- Unlike individual insurance, where each person's risk potential is evaluated to determine insurability, all eligible people can be covered by a group policy, regardless of age or physical condition. The premium for group insurance is calculated based on the characteristics of the group as a whole, such as average age and degree of occupational hazard.

- Unlike individual insurance, where each person's risk potential is evaluated to determine insurability, all eligible people can be covered by a group policy, regardless of age or physical condition. The premium for group insurance is calculated based on the characteristics of the group as a whole, such as average age and degree of occupational hazard.

- You don't need a physical exam.

- Under a group health insurance arrangement; the insurance company agrees to insure all members of the group, regardless of current physical condition or health history.

- The only condition is that the group members must apply for insurance within a specified eligibility period.

- Clearly, this is better for those with chronic health conditions, who might be unable to get individual insurance.

- Many employers offer group health insurance as part of their employee benefits package.

- Other groups that may offer insurance coverage include churches, clubs, trade associations, chambers of commerce, and special-interest groups.

- You can't customize your policy

- In a group insurance situation, the provisions of the policy are negotiated between the insurer and master policy owner(usually an employer or association).

- You don't have the freedom to have provisions included or excluded, and your deductible amount and co-payment percentage are determined in advance.

- In some situations, however, you may be able to choose between two or more insurance plans.

- In large companies, however, even customizing the plans as per the requirement of the employees is possible.

- Group Owners

- Dependant Coverage – may be provided

- Global Coverage

- No Medical Check-ups

- Premiums are shared

- No customization offered

Group Health Plans

There are categories of Group plans:

EGHP - Employer Group Health Plan

The Employer Group Health Plan is a health plan offered to the employees through the employer.

LGHP - Large Group (Employer) Health Plan

- The Large Group Employer Group Health Plan is a health plan promoting this plan would be employing more than 100 employees or among the employers who have come together at least one of them would be employing >/= 100 employees

SGHP - Small Group (Employer) Health Plan

- The Large Group Employer Group Health Plan is a health plan promoting this plan would be employing more than 100 employees or among the employers who have come together

- at least one of them would be employing >/= 100 employees

- This is a plan rolled out by an employer employing less than 20 employees.

- It is a policy that combines the coverage offered in Basic and Major Medical Plans.

- The premiums of these plans are high. Comparatively lower co-insurance.

- The subscriber is required to pay a co-insurance of 20% on the medical expense incurred.

- The concept of Stop-Loss Clause is predominant in Commercial Plans.

0 Comments

Please do not enter any spam link in comment box.